Renowned for her visionary strategies and keen eye for disruptive technologies, Wood’s Ark Investments has made waves with her recent investments in the electric aviation sector.

Archer Aviation (NYSE: ACHR), an electric aircraft developer backed by industry heavyweights Boeing and United Airlines, saw a surge in interest after Wood’s investment of over $30 million in August.1

Archer develops electric vertical takeoff and landing (eVTOL) aircraft for urban landscapes with the purpose of establishing a reliable air taxi service. Last summer, the Federal Aviation Administration issued the company’s flagship Midnight eVTOL a Special Airworthiness Certificate, allowing it to begin test flights. Archer intends to commence piloted “for credit” flight testing in early 2024 with the goal of obtaining FAA Type Certification.

In addition to her investment in Archer Aviation, Wood has also set her sights on Joby Aviation, a leader in the race to develop all-electric air taxis. Through her company Ark Invest, Wood acquired nearly $2 million worth of shares in Joby Aviation (NYSE: JOBY), recognizing the company’s potential to transform urban mobility with its innovative technology.

Joby Aviation just announced a significant deal with Dubai’s Road and Transport Authority (RTA) to introduce air taxi services in the Emirate by early 2026, with initial operations targeted for 2025.

This exclusive agreement, signed at the World Governments Summit in Dubai, grants Joby Aviation the sole rights to operate air taxis in Dubai for six years, positioning the city as a global leader in clean and efficient air travel. With the support of the RTA, including financial backing, Joby aims to establish and expand its service operations seamlessly in Dubai.

Amidst the excitement surrounding Archer and Joby, another player has quietly emerged as a frontrunner in the air taxi electrification race: Surf Air Mobility Inc. (NYSE:SRFM).

Surf Air Mobility is the largest commuter airline in the US based on scheduled departures, flying more than 450,000 passengers on ~75,000 flights to 48 destinations in the US in 2022. The company also generated over $100 million in revenue, and has plans to electrify regional air travel across the US and beyond.

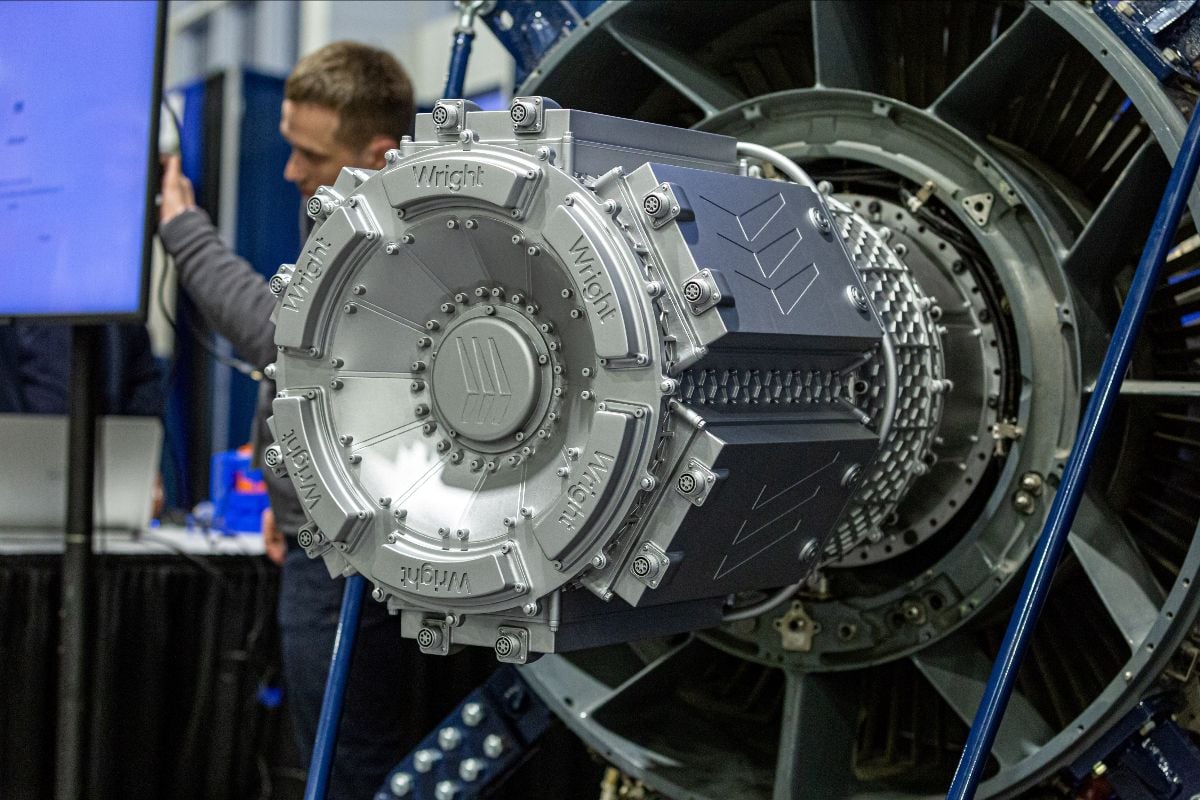

Unlike its competitors, Surf Air Mobility is taking a different approach. Instead of building electric aircraft from scratch, the company is focused on upgrading existing aircraft with fully electric and hybrid-electric engines once its proprietary powertrain technology is certified. This strategic decision can not only accelerate the electrification process but also leverages the proven reliability and existing market adoption of the Cessna Grand Caravan aircraft, setting Surf Air Mobility apart in the rapidly evolving landscape of electric aviation.