Atlantic storm Isha blew through Sint-Truiden, Belgium, a town 65 km from Brussels—and the headquarters of the battery start-up Solithor—earlier this year, knocking over bicycles and motorbikes. Solithor is hoping to make a strong entrance of its own in the battery world with a highly energy-dense battery based on a lithium-metal anode and a novel solid electrolyte.

On paper, Solithor doesn’t stand much chance of competing with the 50-plus other companies developing lithium-metal batteries. Some of them, such as the US firms QuantumScape and Solid Power, have been working on the challenge for more than a decade and thrown hundreds of millions of dollars at it. Solithor started up in 2021 and has since raised only about $14 million in funding and grants.

But the first commercial lithium-metal battery has yet to be made, leaving the door ajar for a company that can move fast with the right technology. Solithor is hoping it can succeed on the strength of an electrolyte made of a composite material featuring a nanoporous silica matrix.

“Silica is cheap and abundant,” says Fanny Bardé, Solithor’s cofounder and chief technology officer. “The lithium ion moves very fast on the wall of that nanoporous matrix,” says Bardé, who developed the electrolyte while working for Imec, a nonprofit nanoelectronics developer in Belgium. Imec gave Solithor exclusive rights to it in exchange for a stake in the company.

The electrolyte is a “solution with a certain viscosity that we pour onto the top of the cathode, and it goes into the pores of the cathode,” where it sets into a solid, Bardé explains in offices above the company’s labs. This approach ensures that the electrolyte can be introduced into existing battery-manufacturing processes. “We don’t want to reinvent everything,” she says.

Bardé’s team has enhanced the electrolyte since the technology came out of Imec. The firm says that in the past 18 months it has been able to reduce the thickness of its electrolyte separator by a factor of 18—thereby enhancing the energy density of its battery.

While the electrolytes used in today’s lithium-ion batteries tend to be liquid or gel, electrolytes being developed for lithium-metal batteries are solid. Most of them are made of ceramic, oxide, polymer, or sulfide materials. Generally, sulfide and oxide electrolytes are powders that are mixed with a cathode material. “So it means you have to press those powders together,” Bardé says. With ceramic or oxide electrolytes, “you have to press very hard,” sometimes with hundreds of megapascals of pressure, she says. “We don’t have that problem.”

Another characteristic of Solithor’s electrolyte is that it does not contain sulfides. Electrolytes that do contain sulfides can be “very difficult to handle at the manufacturing level because the smallest amount of moisture will react to form H2S,” Bardé says.

“Companies developing sulfide solid electrolytes . . . will have to solve the engineering problem around the cell. They bring a new problem. We don’t bring a new problem,” Bardé says.

Investors in QuantumScape, which has been developing a lithium-metal battery with a ceramic electrolyte, appear to be pessimistic about its chances for near-term success. The firm’s share price has plummeted from about $120 in May 2021 to less than $10 today. “I think after all these years, they are still facing the challenge of upscaling at cost,” Bardé says. QuantumScape did not respond to C&EN’s request for comment.

Solid Power, which has developed a sulfide-based electrolyte, has seen its share price fall from over $13 in November 2021 to less than $2 today. Rather than going directly to a solid-state battery with a lithium-metal anode—as it had originally proposed—Solid Power is now targeting a less energy-dense battery featuring a silicon anode.

A challenge facing all lithium-metal battery developers is preventing dendritic spikes from forming on the surface of the anode. The spikes can cause battery failure or even thermal runaway. Tests on Solithor’s electrolyte show that it does not have this problem, Bardé says.

While Solithor is developing its own electrolyte and will use a lithium-metal anode, it is cathode “agnostic,” she says. The firm is trying out lithium-iron-phosphate and nickel-manganese-cobalt cathode materials that it is sourcing from various companies.

Solithor’s initial target application is powering small to midsize electric aircraft. This sector will require batteries with higher energy density than those that have been developed for cars, says Huw Hampson-Jones, the firm’s cofounder and CEO. Solithor has been selected as a battery technology partner in the European Commission–funded Clean Aviation Group, which aims to commercialize green technologies for aviation. It has also formed a partnership with the Belgian aircraft maker Sonaca and is in discussions with auto companies.

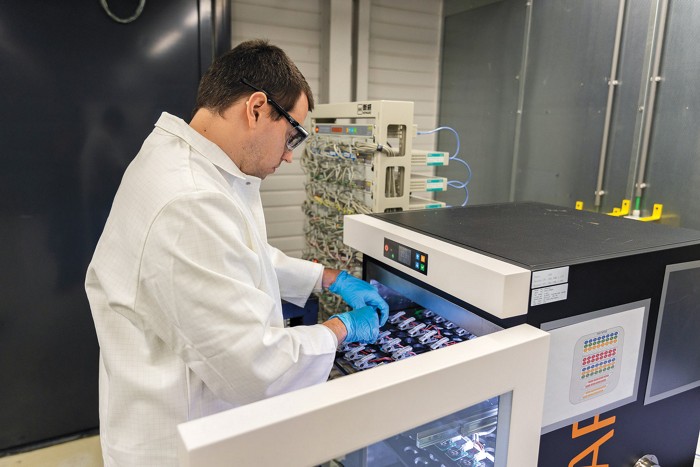

The company moved in to a 3,000 m2 building near Sint-Truiden in August 2023 and is now almost done installing automated equipment that will enable it to increase its production of test cells. Since moving in, Solithor has built wet labs and a 400 m2 dry room for up to 15 scientists with the low levels of air moisture required for making battery cells. Walking around the basketball court–sized dry room, Bardé explains where all the instruments and machines that are soon to arrive will be placed.

Originally constructed for the Swedish automaker Volvo, the building came to Solithor with seven battery-testing bays built to required fireproofing and safety standards. This feature has saved the company time and millions of dollars, says Hampson-Jones, who was CEO of the lithium-sulfur battery developer Oxis Energy before it went bankrupt. One of Hampson-Jones’s lessons from his time at Oxis was the huge expense and delay involved in sending prototype cells off-site for testing.

“With what we have now, you could walk from the dry-room production and put the cells on test within a matter of minutes rather than hours or days,” Hampson-Jones says.

Solithor has 22 staffers, 15 of whom have PhDs. Almost all are scientists working on the company’s core technology. All have some kind of background in the battery industry, most notably Solithor’s head of cell design, process, and upscaling, who comes from Tesla. The firm plans to hire an additional 24 staff this year. “We are still looking for seven or eight positions to fill very soon,” Bardé says.

Even before the company moved in to the Sint-Truiden facility, it had scaled up production of its electrolyte to hundreds of grams of material. At this scale, “we can really start to get close to the real design of the future product,” Bardé says. Although the firm has been making good progress, it is far behind many lithium-metal battery developers that are making their electrolytes in substantially greater volumes.

To ensure that Solithor can continue to scale up, Hampson-Jones plans to raise more than $30 million in a series A funding round by year’s end. The firm reckons it has enough space on its current site to produce 250,000 or more battery cells annually—enough to demonstrate that its technology is fully scalable.

Indeed, cell manufacturers aren’t going to buy or license Solithor’s technology unless the whole technology is scalable, says Chloe Herrera, an analyst who covers battery technology for Lux Research. “This requires pilot manufacturing. It’s a very capital-intensive process,” she says.

Solithor is already making a battery cell with an energy density of about 245 W·h/kg. Bardé and Hampson-Jones are clear on what they think their technology can achieve and by when. “Four hundred watt-hours per kilogram is the ultimate aim,” Hampson-Jones says. High-performing lithium-ion batteries currently on the market have an energy density that is about 30% less.

Solithor will be in a position to go commercial somewhere between 2029 and 2031, according to Hampson-Jones. That’s about when Herrera expects the leading developers of lithium-metal batteries will bring their first products to the market.

“I haven’t seen enough progress in lithium-metal batteries to suggest that you would see them before 2030,” she says.

The most advanced developers of solid-state lithium-metal batteries are Toyota, the Taiwanese firm ProLogium Technology, and some Chinese companies, Herrera says. US-based Factorial Energy, one of C&EN’s 10 Start-Ups to Watch in 2021, also “is definitely a company that has emerged as very promising,” Herrera says.

Bardé realizes that the competition is fierce, but she is hoping that the composite electrolyte Solithor is developing will enable it to avoid some of the challenges—and delays—experienced by its rivals. “We have a clear path indeed,” Bardé says.